Many companies and organizations encounter a plethora of issues in today’s complex and changing business market, which can have an influence on their performance, reputation, and long-term viability. Organizations use a variety of ways to efficiently address these difficulties, one of which is the introduction of internal audits.These audits are important because they will play a crucial role in identifying and evaluating the risks faced by the companies or organizations. These audits help organizations mitigate risks and keep the companies following the rules, laws, and regulations. They help companies make continuous improvements.

Internal audit reports are critical tools for firms because they give significant insights into the efficacy of their internal controls, compliance, and overall risk management strategies. These reports serve as a road map for improvement, allowing management to make educated decisions to increase operational efficiency and reduce risks.

Internal audits and the associated internal audit reports are key components of a company’s governance architecture. These activities contribute to transparency, accountability, and long-term growth by offering independent and objective evaluations, ensuring that businesses successfully manage risks, improve operational efficiency, and accomplish their strategic goals.

WHAT IS AN INTERNAL AUDIT AND ITS REPORT?

An internal audit is a systematic and independent evaluation of an organization’s processes, controls, and operations conducted by an internal audit department or team. The purpose of an internal audit is to assess the effectiveness, efficiency, and compliance of an organization’s internal systems, identify areas of risk, and provide recommendations for improvement.

Internal audits serve as an organization’s proactive and objective assurance role. Internal auditors who are not involved in the processes or functions being audited often conduct them. Internal auditors analyze financial records, operational procedures, internal controls, and legal, regulatory, and internal policy compliance.

Internal Audit Reports:

An internal audit report is a document that outlines the results of an internal audit’s findings, conclusions, and recommendations. It is a formal report that the internal audit team or department creates and typically sends to management, the audit committee, and other important stakeholders within the company.

The internal audit report is a communication tool that gives an impartial assessment of the areas or processes that have been reviewed. It summarizes the audit findings, including any defects, noncompliance concerns, control gaps, or opportunities for improvement discovered during the audit. The report also contains recommendations for dealing with the shortcomings observed and improving the audited processes or controls.

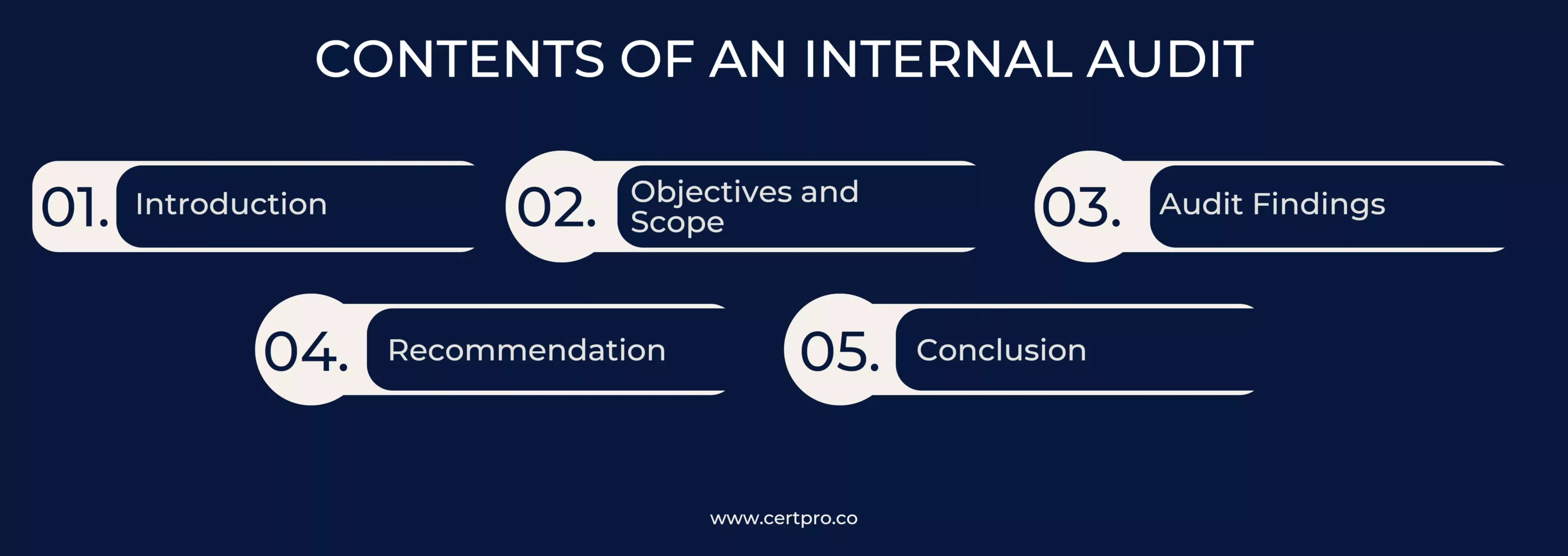

CONTENTS OF AN INTERNAL AUDIT

A typical internal audit report comprises numerous important parts and content categories. While the particular structure and content may vary depending on the needs of the company, the following are some frequent characteristics included in an internal audit report:

The particular content and structure of an internal audit report may differ based on the business, industry, and audit aim.

1. Introduction: The introduction section offers background information regarding the audit, such as the objective, scope, and criteria used to conduct the audit. It may also provide an overview of the audit technique and any restrictions discovered.

2. Objectives and Scope: This section clearly specifies the auditor’s objectives and explains the audited areas or procedures. It defines the timeline as well as any geographical or departmental boundaries.

3. Audit Findings: This is an important component that reveals the audit’s thorough findings. It highlights the audit’s findings, problems, or noncompliance, including any control flaws, operational inefficiencies, or compliance gaps.

4. Recommendation: This section contains specific advice for dealing with the concerns discovered and improving the audited area or process. Recommendations should be actionable, realistic, and adapted to the circumstances of the company.

5. Conclusion: The conclusion summarizes the report’s essential points, reiterates the main conclusions, and underlines the necessity of addressing the highlighted difficulties. It may also offer a forecast for future audits or actions.

AN EXAMPLE OF AN INTERNAL AUDIT REPORT

We are currently in the process of incorporating a straightforward example of an internal audit report. A strong audit report is vital for successfully conveying an audit’s findings and conclusions. Here are some crucial stages to writing a thorough and well-structured audit report:

Identify the goal and scope: Familiarize yourself with the audit’s purpose and objectives. Understand the audit’s scope, including the areas or procedures that were examined, the time period covered, and any particular criteria or standards that were utilized.

Organize your report as follows: Structure your report in a logical and orderly fashion. An audit report typically comprises the following sections:

A) Title: Make it clear that this is an audit report and give it an easy-to-understand and informative title.

B) Introduction: Explain the auditor’s objectives, scope, and methodology. Describe the audit’s criteria or guidelines.

C) Background: Describe the audited entity’s purpose, activities, and any noteworthy changes or developments.

D) Results: Present the audit’s results. Clearly state the findings, faults, or defects discovered throughout the auditing process. Provide sufficient proof and documentation to back up your conclusions.

E) Conclusions: Based on the data, draw conclusions. Determine the importance and effect of the audited entity’s findings. Any persistent or systemic concerns should be highlighted.

F) Management reaction: If available, include the management response to the findings and suggestions. This facilitates openness and accountability.

G) Appendices: Include any other papers, charts, graphs, or material that will help clarify or support the conclusions.

Use clear and concise language: Write in simple, plain, and jargon-free language. Use basic language to ensure that a wide variety of readers can understand the report. Avoid ambiguity and ensure that your message is correctly understood.

Context and Analysis: Provide context and analysis while presenting the findings to help readers comprehend the implications. Explain the reasons and probable effects of the difficulties you’ve found. To support your analysis, use data, statistics, and benchmarks as needed.

Review and proofread: Before finishing the report, thoroughly review and proofread it. Look for grammatical errors, typos, and inconsistencies in the content. Check that the report respects the appropriate formatting rules and, if relevant, the organization’s style guide.

Consider your intended audience: Customize the report to meet the requirements and expectations of the target audience. Consider their familiarity with the topic area as well as their information needs. Use vocabulary and examples that the reader will understand.

Follow professional standards: Make sure that audit reporting complies with the professional standards and guidelines set forth by pertinent agencies or organizations, such as the International Standards for the Professional Practice of Internal Auditing (Standards) or the Generally Accepted Government Auditing Standards (GAGAS).

TYPES OF INTERNAL AUDIT REPORTS

Internal audits are performed within organizations to assess and enhance internal controls, risk management procedures, and operational effectiveness. Here are some examples of frequent types of internal audits:

1. Financial auditing: Financial auditing focuses on an organization’s financial records, transactions, and financial reporting systems. The goal is to assure accuracy, adherence to accounting principles and standards, and the identification of any financial risks or abnormalities.

2. Operational audits: Operational audits evaluate the efficiency and effectiveness of a company’s operations, processes, and procedures. They investigate topics such as manufacturing, supply chain management, human resources, information technology, and customer service. The goal is to discover areas for improvement, cost savings, and risk reduction.

3. Compliance audits: Compliance audits assess an organization’s compliance with laws, regulations, policies, and industry standards. These audits guarantee that the business is adhering to all applicable legal, regulatory, and internal regulations. Data privacy, occupational health and safety, environmental restrictions, and labor laws are common topics for compliance audits.

4. Information Systems Audit: IT audits, also known as information systems audits, analyze the security, dependability, and effectiveness of an organization’s information technology systems. They examine the protections and controls in place to ensure data integrity, confidentiality, and availability. IT audits may also include the evaluation of compliance with applicable IT frameworks or standards, such as ISO 27001.

Finally, internal audits are critical to assessing and improving an organization’s internal controls, risk management processes, and operational efficiency. Internal auditors give useful insights and recommendations for improvement by performing many sorts of audits, including financial, operational, compliance, information systems, risk management, fraud, governance, and environmental audits.

FAQ

What are the important sections of an internal audit report?

The executive summary, introduction, goals and scope, audit findings, risk assessment, compliance assessment, control evaluation, recommendations, management reaction, and conclusion are typical components of an internal audit report.

What data should be included in an internal audit report summary?

The executive summary should include a high-level overview of the audit’s goals, scope, main findings, and recommendations. It should describe the major aspects of the report in a concise manner.

Is it possible for an internal audit report to differ?

Yes, the content and structure of an internal audit report might vary based on the requirements of the business, industry standards, and the objective of the audit. Each business may have its own set of templates or forms to adhere to while still including the necessary portions and information.

How can a business use an internal audit report?

Organizations utilize internal audit reports to discover vulnerabilities, risks, and noncompliance in their operations. It serves as a foundation for making changes, strengthening controls, and guaranteeing compliance with relevant legislation and standards.

Is it okay to share an audit report with external stakeholders?

In specific instances, an organization may opt to disclose its internal audit report to external stakeholders such as regulators, investors, or external auditors. However, the organization’s policies, legal obligations, and confidentiality concerns typically govern the decision to share the report with others.

About the Author

ANUPAM SAHA

Anupam Saha, an accomplished Audit Team Leader, possesses expertise in implementing and managing standards across diverse domains. Serving as an ISO 27001 Lead Auditor, Anupam spearheads the establishment and optimization of robust information security frameworks.

FINDING THE RIGHT AUDITOR: THE ULTIMATE CHECKLIST

Selecting an auditor to implement industry-specific rules and regulations is vital. The choice can influence the company’s growth and financial health. Therefore, choosing the right auditor offers valuable insights and ensures compliance and economic stability. You...

AI Audit Guidelines and Best Practices: Applying AI Towards Its Full Potential

Artificial Intelligence is entering different industries, where it is used for customer handling, data management, and documentation processes. The interference of AI is increasing concerns regarding ethical practice and safety. Therefore, AI audits have become more...

AUDIT LOG: INFORMATION SECURITY BEST PRACTICES FOR BUSINESSES

An audit log is the best information security practice for organizations. This article elaborates on the operational process of audit logs and how companies utilize them for business growth. What is an audit log, and how does it work for organizations? For more...