The foundation of assurance in the ever-changing world of finance is audit evidence, which emphasizes openness and trust. It provides regulatory agencies, investors, and stakeholders with a trustworthy road map to help them navigate the complex labyrinth of financial statements. It acts as a compass for these parties. Audit proof, encompassing diverse types such as documents, observations, and corroborating data, acts as a beacon of credibility, illuminating the accuracy and fairness of financial information. These foundational pieces of evidence not only support the assertions made by organizations about their financial standing and performance, but they also give stakeholders the reassurance they need to put their faith in the accuracy of the information being offered.

The importance of the audit trail resonates with the core values of accountability and dependability throughout the financial system. The variety of audit evidence types—which include electronic records, third-party confirmations, and physical documents like bank statements and invoices—paints a complete picture. The diligent collection and examination of data by auditors protects the interests of creditors, investors, and regulatory agencies by acting as a barrier against false information and deception. Audit proof shines as a ray of light in an otherwise unclear environment, providing comfort and promoting trust in the integrity and impartiality of financial reporting.

UNDERSTANDING AUDIT EVIDENCE

In any audit, the main goal is to determine whether the financial statements of the company comply with generally accepted accounting principles (GAAP), international financial reporting standards (IFRS), or other pertinent accounting standards that are applicable in the jurisdiction of the entity. For auditors and accountants to carry out their responsibilities, publicly listed companies are often required to provide shareholders with fully audited financial statements regularly. This emphasizes how crucial it is to efficiently gather and arrange auditing evidence. To put it simply, audit proof is the basis upon which auditors base their conclusions on the integrity and correctness of financial accounts, making it easier to assess their faithfulness.

Audit evidence comprises a diverse array of information that auditors diligently gather to assess the accuracy and reliability of a company’s financial statements. This evidence encompasses tangible assets, written records, and analytical procedures, forming a comprehensive dataset that illuminates the intricacies of financial transactions and processes. Through meticulous collection and analysis, auditors gain insight into the veracity of the presented financial information, enabling informed decisions regarding the company’s financial position and performance.

Some essential features may be used to evaluate the quality of audit evidence, including:

1. Reliability: Reliable audit trail evidence comes from impartial, independent sources and is regarded as reliable and trustworthy. It must come from highly credible sources and be devoid of prejudice or significant inaccuracies.

2. Nature: Nature has to do with the type or category of information that is being received. This includes a range of media, including court records, PowerPoints, staff member statements, and direct physical proof.

3. Relevance: The audit evidence needs to have a clear connection to the financial statements’ testable claims. It must be relevant to the particular accounts, transactions, or disclosures that are being examined.

4. Adequacy: Enough data from the audit adds credibility to the auditor’s findings and assessments. The auditor must be able to reach reasonable conclusions based on sufficient evidence, both in terms of quantity and quality.

5. Consistency: Standardized techniques and methodologies are used to acquire a consistent audit trail, guaranteeing consistency and comparability throughout the audit process. Maintaining consistency makes it easier for auditors to assess changes and trends over time.

Through evaluation of the degree to which audit data demonstrates these attributes, auditors can augment the caliber and dependability of their audit conclusions, thus fortifying the legitimacy and reliability of financial reporting.

WHY IS AUDIT EVIDENCE IMPORTANT?

Audit evidence holds significant importance in upholding the credibility and reliability of financial reporting. It fulfills several essential functions, including:

1. Supports Auditor’s Opinion: As part of their professional duty, auditors are mandated to render an opinion regarding the absence of material misstatements in the financial statements. In this regard, audit trail evidence assumes a pivotal role, acting as the substantiation for their opinion by offering objective and verifiable evidence that supports their conclusions. By methodically going over and evaluating various types of evidence, auditors gain a thorough understanding of the financial data provided. This understanding allows them to confidently tell stakeholders and regulatory bodies that the financial statements are accurate and reliable.

2. Minimizes Risk of Errors and Fraud: By conducting thorough evidence collection, auditors can effectively mitigate the risk of errors and fraudulent activities within financial data, thus enhancing the accuracy and reliability of information provided to investors. This proactive approach not only shields investors from misleading financial reporting but also promotes market stability and confidence.

3. Improves Accountability and Transparency: In addition to ensuring that stakeholders are given assurances regarding the adherence of financial reporting to established accounting standards and regulatory frameworks, the use of strong audit evidence in the audit process serves to strengthen transparency and accountability within an organization and foster greater confidence in the integrity of the organization’s financial disclosures and operations.

4. Strengthens Internal Regulations: Organizations obtain important insights into the effectiveness of their internal control systems by carefully evaluating audit trails. This allows management to identify areas of weakness and implement improvements to financial reporting procedures, strengthening governance frameworks and enhancing stakeholder confidence in the correctness and dependability of financial information.

5. Financial Statement Verification: Audit trail is crucial for confirming the completeness and correctness of financial statements. Through a thorough examination and assessment of several audit evidence types, including papers, records, and transactions, auditors can determine the veracity of the data reported in the financial reports.

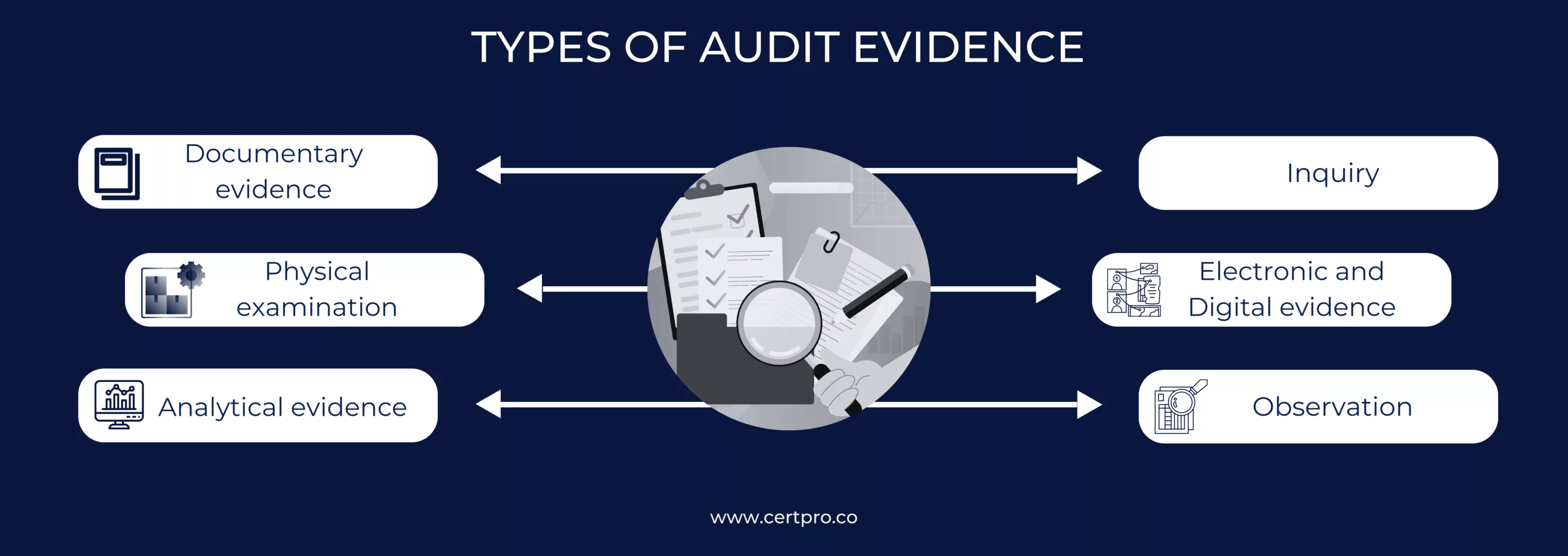

TYPES OF AUDIT EVIDENCE

In the realm of auditing, the utilization of diverse audit evidence types is paramount for conducting thorough assessments and ensuring the accuracy and integrity of financial information. Each audit evidence types serves a distinct purpose in the audit process, contributing to a comprehensive evaluation of an organization’s financial standing and internal controls. By strategically combining these methods, auditors can enhance the validity and reliability of their audit results.

1. Documentary Evidence: Written records and papers are included in documentary evidence, which is the most common type of audit evidence. It provides verifiable and physical sources of information. Examples include bank statements that provide proof of cash balances and transactions, which is essential for verifying the accuracy of an organization’s financial records, contracts, and agreements that detail obligations and commitments, and invoices and receipts that validate transactions and the timing of financial events.

2. Physical Examination: In order to confirm an asset’s existence, ownership, or condition and provide direct evidence that is essential to the audit process, a physical examination involves carefully inspecting tangible assets such as inventories, machinery, or paperwork. When an auditor examines physical assets, they can record their observations and conclusions in detail using this verification approach, which is often documented in audit work papers.

3. Analytical Evidence: The use of financial and non-financial data analysis techniques to identify patterns, trends, anomalies, or irregular fluctuations that may indicate possible problems or areas of concern is referred to as analytical evidence, one of the key audit evidence types. Examples of this type of evidence include ratio analysis, which is used to evaluate a company’s financial health, trend analysis, which is used to identify significant changes over time, and testimonials and confirmations, such as letters of confirmation, which are used to independently verify balances, transactions, or expert opinions for specialized valuation assessments. All of these methods are part of the thorough assessment that auditors perform during the audit process.

4. Inquiry: Inquiry involves the process of soliciting information from individuals possessing expertise either internally within the organization, such as management and employees, or externally, including auditors and regulators, to elucidate intricate transactions, validate accounting estimates, and reveal potential unrecorded liabilities or contingent risks, thereby contributing to a comprehensive assessment of the organization’s financial affairs during the audit process.

5. Electronic and Digital evidence: These days, with everything being digital, electronic and digital evidence are very important when it comes to auditing. This includes information that is stored in digital formats like email correspondence, which can be used as proof of agreements, transactions, or decisions within the organization, as well as computerized accounting records like databases, financial software, and ledgers, which auditors rely on to obtain proof of an organization’s financial transactions and accounts.

6. Observation: Observation, as one of the crucial audit evidence types, involves the direct witnessing of processes being executed and controls being applied within an organization. This enables auditors to assess the effectiveness of internal controls and discern potential weaknesses in control mechanisms by scrutinizing key business activities firsthand. As a result, observation contributes valuable insights to the comprehensive evaluation conducted during the audit process.

In conclusion, the strategic combination of various audit evidence types is essential for conducting comprehensive evaluations of an organization’s financial standing and internal controls. By carefully selecting and incorporating relevant information, auditors can enhance the validity and reliability of their audit results, thereby providing stakeholders with confidence in the integrity of the financial reporting process.

WHICH DOCUMENTS ARE ESSENTIAL FOR AN AUDIT?

The documents required for an audit can vary based on the nature of the audit and the industry involved. However, certain standard documents are typically requested to ensure a thorough examination of the financial records. These documents include:

1. Financial Statements: These statements provide a comprehensive overview of the financial position, performance, and cash flows of the organization. They include the balance sheet, income statement, and cash flow statement.

2. Purchase Orders, Invoices, and Supporting Documentations: These records offer proof of transactions, including sales and purchases. They support auditors in confirming the completeness and correctness of financial records.

3. Reconciliations and Bank Statements: To validate transactions and cash balances, bank statements are necessary. Reconciliations assist in finding inconsistencies by ensuring that the organization’s records match those of the bank.

4. Income Tax Returns: The organization’s taxable income, credits, and deductions are listed on tax returns. In order to evaluate tax compliance and balance tax provisions with financial statements, auditors review tax returns.

5. Agreements and Contracts: The organization’s rights and duties regarding certain transactions are outlined in contracts and agreements. Auditors go over these agreements to make sure the conditions of the contracts are being followed and to evaluate how they affect the financial statements.

6. Manuals of Policies and Procedures: Internal controls, accounting rules, and operational standards of the company are recorded in policy and procedure manuals. To determine if internal controls are functioning effectively and whether accounting rules are being followed, auditors examine these manuals.

7. Documentation on Information Technology: System setups, security guidelines, and data backup protocols are all included in IT documentation. To reduce the risks associated with data integrity and confidentiality, auditors evaluate IT controls.

8. Board Meeting Minutes: Minutes from board meetings record important choices and conversations made by the group that governs the company. Auditors examine these minutes to understand significant events and managerial choices.

PROCESS OF GATHERING AUDIT EVIDENCE

Throughout the audit engagement, the process of obtaining audit evidence is essential and ongoing, guaranteeing a comprehensive review of financial statements. This intricate procedure consists of numerous crucial steps:

1. Planning and Assessing Risk: In the planning and risk assessment stage, auditors delve deeply into the client’s business operations with the goal of understanding their complex dynamics and subtleties. Investigating a variety of topics, including the regulatory environment, the industrial landscape, and internal control systems, is required for this. Furthermore, taking into account elements like inherent risks, control risks, and fraud risks, auditors carefully pinpoint any possible places in the financial statements where serious misstatements might occur. With this thorough insight in hand, auditors go on to create a complete audit approach that fits the unique needs and risk profile of their clients.

2. Implementing Auditing Processes: Conducting audit procedures involves a meticulous process where auditors, guided by the risks identified during the planning phase, meticulously select and execute a tailored set of investigative measures. These procedures are designed not only to address the identified risks comprehensively but also to encompass a diverse range of audit techniques, including substantive testing and tests of controls. Through this strategic approach, auditors aim to gather a robust body of evidence that provides insight into the accuracy, completeness, and reliability of the financial statements.

3. Evaluating the Evidence: Auditors conduct a thorough and methodical examination of the evidence to determine its relevance, reliability, sufficiency, and suitability. This entails closely examining a number of characteristics of the collected data, including its consistency, type, and source, to make sure it offers a thorough comprehension of the financial statements. Auditors also take into account the methods used to gather the evidence and any biases or restrictions that can affect its validity. Auditors seek to get significant insights that support the comprehensive review of the correctness and integrity of the financial statements through this stringent evaluation procedure.

4. Making Conclusions: Concluding remarks entails combining the results of the thorough assessment of the evidence, in which auditors examine the information gathered in accordance with relevant industry standards, legal requirements, and accounting standards. In addition to evaluating the financial accounts’ integrity and fairness, this procedure involves weighing the ramifications of any inconsistencies or abnormalities that are found. In addition, auditors may consider management’s statements, external corroborating evidence, and the efficacy of internal controls when drawing their judgments. These findings ultimately constitute the basis for reassuring stakeholders about the accuracy and consistency of the financial data that has been disclosed.

FAQ

Can audit evidence be obtained solely through documentation?

While documentation is an important source of audit evidence, auditors typically supplement it with other procedures to obtain a comprehensive understanding of the entity’s financial position and performance. Auditors may need to corroborate documentary evidence with oral explanations, observations, or confirmations from third parties to ensure its accuracy and completeness.

What obstacles do auditors confront when acquiring and assessing audit evidence, and how are these obstacles managed?

Auditors overcome obstacles like uncooperative clients, complex transactions, and evidence reliability concerns through skepticism, thorough planning, specialized procedures, ethics adherence, legal guidance, specialist involvement, and clear client communication.

How does an audit trail contribute to risk management?

An audit trail helps identify and mitigate the risks of errors, fraud, and non-compliance. By ensuring the accuracy and reliability of financial information, it enables businesses to make informed decisions and enhance their overall risk management strategies.

What should businesses consider when preparing for an audit?

Businesses should ensure they have accurate and complete financial records, maintain documentation of transactions and agreements, establish robust internal controls, and cooperate fully with auditors. Proper preparation can streamline the audit process and contribute to the reliability of audit proof.

Can audit evidence obtained in a previous audit be reused in subsequent audits?

Audit evidence obtained in a previous audit may be considered for reuse in subsequent audits if it remains relevant and reliable. However, auditors should assess whether any changes in circumstances or risk factors affect the appropriateness of using the evidence in the current audit context.

About the Author

SHREYAS SHASTHA DRUPADHA

Shreyas Shastha Drupadha, a Senior Business Consultant. Serving as an ISO 27001 Lead Auditor, Shreyas ensures the establishment of robust information security management systems. His expertise also encompasses GDPR, HIPAA, CCPA, and PIPEDA implementation.

AI Audit Guidelines and Best Practices: Applying AI Towards Its Full Potential

Artificial Intelligence is entering different industries, where it is used for customer handling, data management, and documentation processes. The interference of AI is increasing concerns regarding ethical practice and safety. Therefore, AI audits have become more...

AUDIT LOG: INFORMATION SECURITY BEST PRACTICES FOR BUSINESSES

An audit log is the best information security practice for organizations. This article elaborates on the operational process of audit logs and how companies utilize them for business growth. What is an audit log, and how does it work for organizations? For more...

MASTERING IN SECURITY AUDIT IN 2024: BEST PRACTICES FOR BUSINESSES

A security audit is essential for companies to maintain robust information security controls. Therefore, audits become more relevant as the number of incidents of data breaches increases. A study suggested that, from 2021 to 2022, the average cost of data breaches...