While internal audit frequency varies, regular audits provide considerable benefits in terms of risk assessment, compliance, financial correctness, process improvement, and management accountability.

In this article, we will look at the significance of performing regular internal audits, the benefits of internal audits, and how they contribute to the success and sustainability of firms in today’s fast-paced corporate environment. Businesses may achieve long-term success by understanding the benefits of frequent internal audits, strengthening their control systems, increasing transparency, and proactively addressing emerging difficulties.

WHAT IS INTERNAL AUDITING?

Internal auditing gives a company knowledge and advice on how to enhance its processes, manage risks, and accomplish its goals. Internal auditors do it because they are independent of the areas they audit and have a thorough awareness of the organization’s operations, risks, and controls.

Internal auditors function in a methodical and well-defined manner. This process comprises organizing the audit, acquiring and analyzing pertinent data, conducting interviews and fieldwork, measuring control effectiveness, identifying areas of noncompliance or weakness, and conveying findings and suggestions to management.

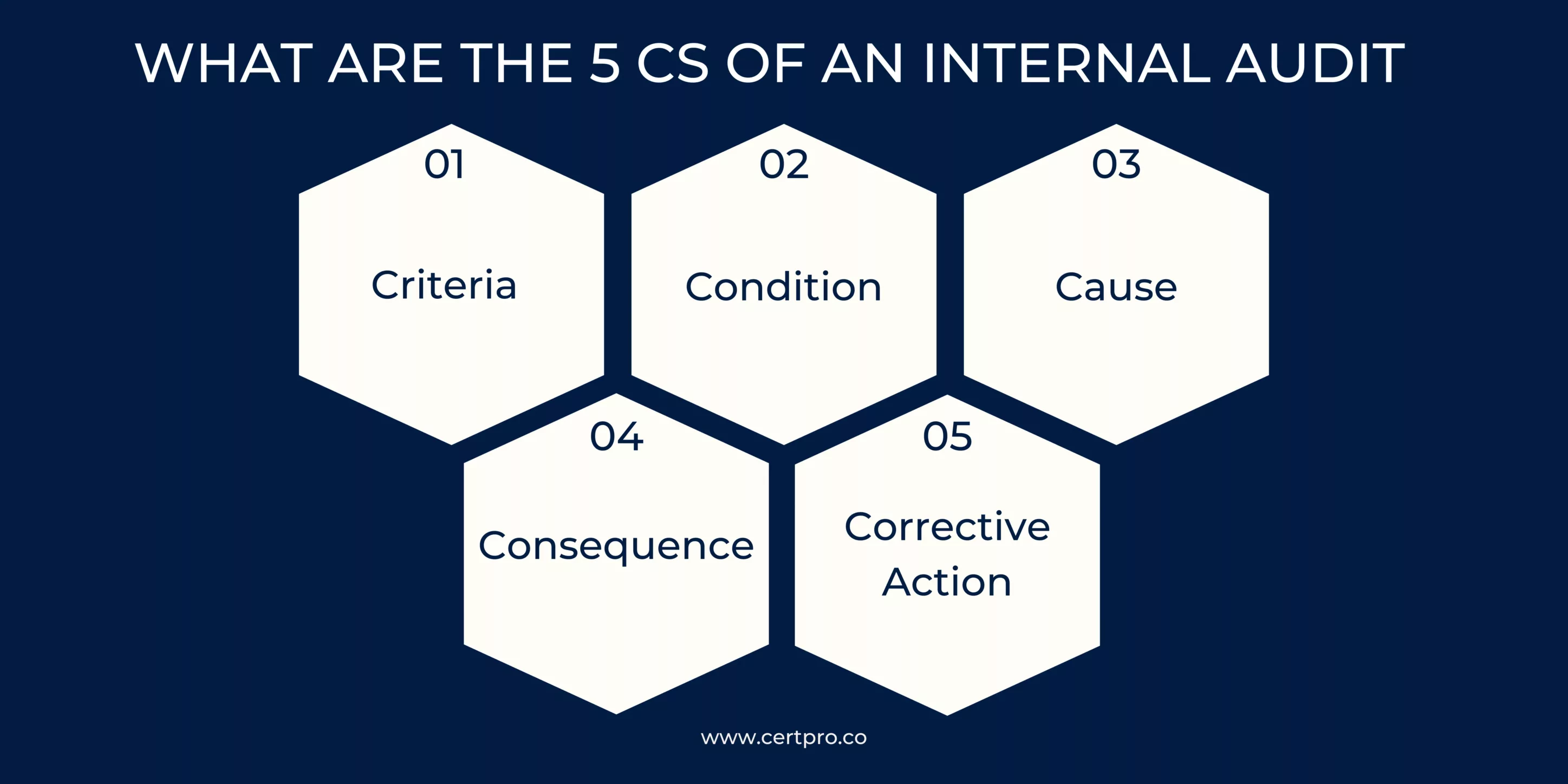

WHAT ARE THE FIVE C’S OF INTERNAL AUDITING?

Condition: Condition represents the current state or situation observed during the audit. It is the factual data that auditors have gathered about the procedures, systems, controls, or other areas under review. The condition provides the basis for evaluating whether the actual performance aligns with the established criteria.

Cause: Cause refers to the root or underlying factors contributing to the identified condition. In an internal audit, auditors aim to identify the reasons behind any deviations, inefficiencies, or non-compliance observed during the audit. Understanding the causes helps in developing effective recommendations for improvement.

Consequence: The consequence represents the potential impact or effect of the identified condition. It involves assessing the implications of the identified issues on the organization’s objectives, operations, finances, reputation, or compliance. Evaluating the consequences helps prioritize areas for corrective action based on the significance of the impact.

Corrective Action: Corrective action involves the steps or measures recommended to address the identified issues and improve the condition. It includes specific actions to rectify the root causes, mitigate the consequences, and prevent similar issues from recurring. Corrective actions should be practical, feasible, and aligned with the organization’s goals and objectives.

These five elements—criteria, condition, cause, consequence, and corrective action—form a systematic approach to internal auditing. They provide a structured framework for auditors to assess, analyze, and recommend improvements in various areas of the organization, thereby enhancing overall effectiveness, efficiency, and compliance.

WHAT IS THE BENEFITS OF INTERNAL AUDITING?

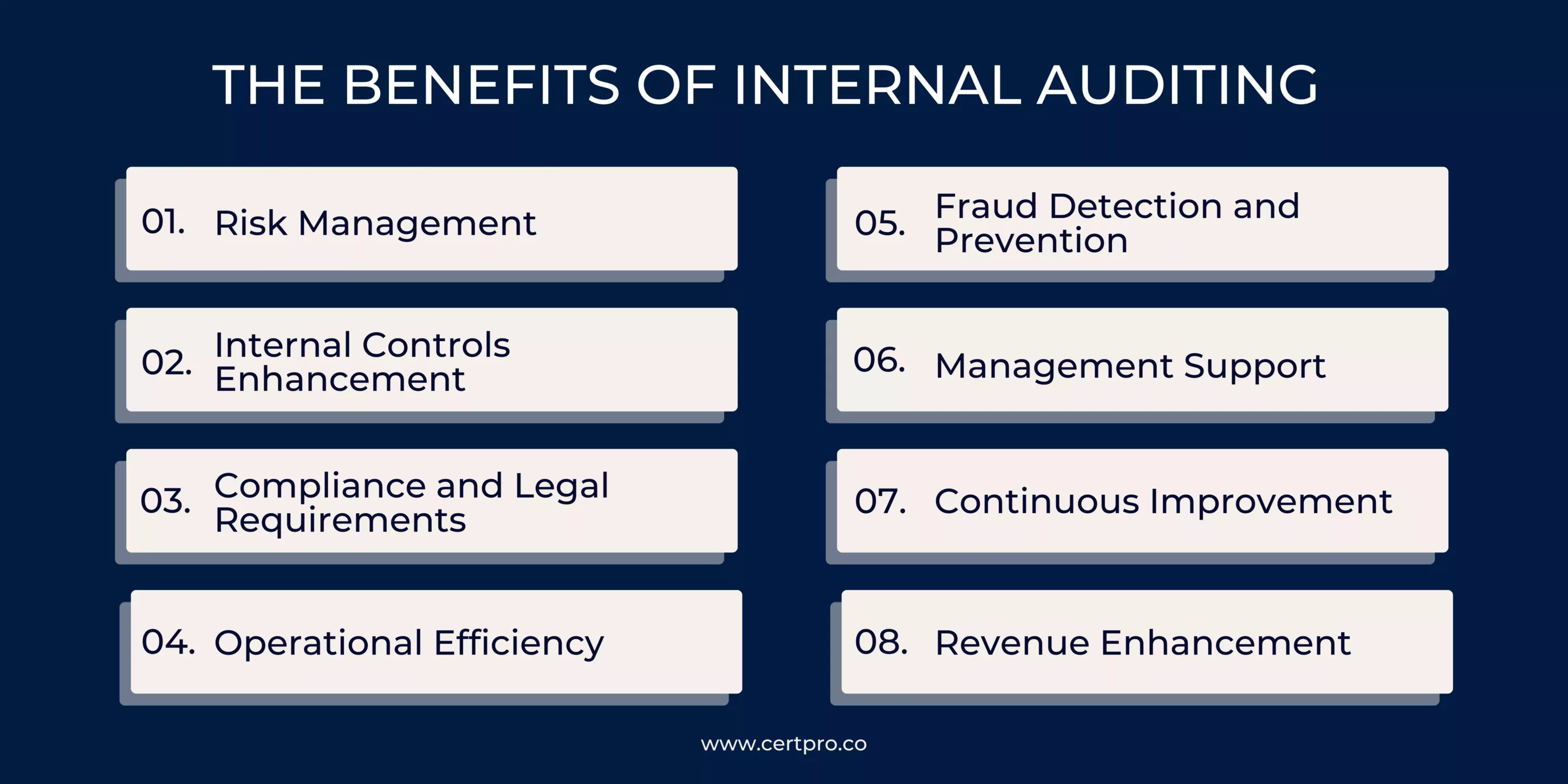

2. Internal Controls Enhancement: Internal auditors evaluate the effectiveness of internal controls and provide recommendations for improvement. By assessing control systems and identifying weaknesses or gaps, they help organizations strengthen their internal control environment. This, in turn, reduces the risk of fraud, errors, and non-compliance.

3. Compliance and Legal Requirements: Internal auditors ensure that organizations comply with applicable laws, regulations, and internal policies. They review processes, transactions, and records to verify compliance and identify any non-compliance issues. By addressing compliance gaps, internal auditors help organizations avoid legal consequences, reputational damage, and financial penalties.

4. Operational Efficiency: Internal auditing helps organizations improve their operational efficiency and effectiveness. By reviewing business processes and identifying areas for improvement, internal auditors contribute to streamlining operations, reducing costs, and enhancing productivity. They also provide recommendations for optimizing resource utilization and achieving organizational objectives.

5. Fraud Detection and Prevention: Internal auditors play a crucial role in detecting and preventing fraud within organizations. Through their independent and objective assessments, they identify red flags, irregularities, and potential fraud schemes. By implementing fraud prevention measures and conducting investigations, internal auditors safeguard organizational assets and integrity.

6. Management Support: Internal auditors provide valuable insights and information to management. Their findings and recommendations help management make informed decisions, strengthen governance, and improve overall organizational performance. Internal auditors act as trusted advisors to management, supporting them in achieving strategic objectives and driving positive change.

7. Continuous Improvement: Internal auditing fosters a culture of continuous improvement within organizations. Through their regular assessments and feedback, internal auditors help identify areas for enhancement and drive positive change. They contribute to the development and implementation of best practices, promoting innovation, efficiency, and effectiveness throughout the organization.

8. Revenue Enhancement: Internal auditors can identify opportunities for revenue generation or enhancement. By reviewing sales processes, pricing strategies, customer contracts, and revenue recognition practices, they can provide recommendations to improve revenue generation and capture missed opportunities. This can result in increased revenues and improved cost recovery.

Harnessing the Potential of Regular Internal Audits: Ensuring Compliance Safely

2. Compliance and Regulatory Requirements: Internal quality audits serve to assess companies’ conformity with relevant laws, regulations, and industry standards. Through periodic audits, organizations can evaluate their adherence to these guidelines, identify areas where compliance may be lacking, and take the necessary measures to address any deficiencies. By doing so, these audits help mitigate legal and regulatory risks, safeguard the organization’s reputation, and prevent potential penalties or sanctions.

3. Financial Accuracy and Fraud Prevention: Accurate and dependable financial information is vital for decision-making, reporting, and stakeholder trust. Internal audits ensure compliance with accounting rules by evaluating transactions, controls, and systems to prevent errors, irregularities, and fraud. Frequent audits detect and prevent fraudulent acts, safeguarding assets and financial integrity while enhancing transparency with comprehensive, accurate, and timely financial data.

4. Process improvement: Internal audits evaluate the effectiveness and efficiency of an organization’s procedures and activities. By examining internal controls, operational procedures, and business practices, auditors can identify areas for improvement, provide best practices, and optimize processes. Regular audits enable organizations to continuously enhance their operations, leading to improved efficiency, productivity, and cost-effectiveness.

5. Internal Control Evaluation: Internal audits are performed to determine the sufficiency and effectiveness of an organization’s internal controls. Auditors can detect control deficiencies, prospective breakdowns, or instances of noncompliance by analyzing control systems, rules, and procedures. The benefits of conducting internal audits frequently give management insight into the dependability of internal controls and allow for prompt remedial steps to enhance them.

6. Management Accountability and openness: Internal audits promote accountability and transparency within a company. By independently assessing procedures, controls, and performance, auditors provide an impartial examination of management’s activities and decisions. Regular audits hold management responsible for their duties and ensure alignment with the organization’s goals. Additionally, internal audits enhance transparency by providing a clear view of the organization’s activities and financial reporting. This transparency fosters trust among stakeholders, including shareholders, investors, and regulatory bodies.

7. Continuous Monitoring and Improvement: Internal audits are a component of an organization’s continuous monitoring and improvement process. Companies can monitor the execution of remedial measures and improvements arising from prior audits by performing audits at regular intervals. This iterative technique assists businesses in sustaining and improving their internal control environment over time.

Regularly conducted internal audits offer valuable perspectives on an organization’s operations, risk profile, and control environment. These audits provide management with insightful information that aids in making well-informed decisions, enhancing operational efficiency, managing risks effectively, and ensuring compliance with regulatory requirements.

PLANNING FOR CONDUCTING EFFECTIVE INTERNAL AUDITS

FAQ

Who is in charge of internal audits?

How can regular internal audits encourage continual improvement?

Can frequent internal audits improve operational efficiency?

How can regular internal audits help with compliance?

What is management's role in regular internal audits?

About the Author

ANUPAM SAHA

Anupam Saha, an accomplished Audit Team Leader, possesses expertise in implementing and managing standards across diverse domains. Serving as an ISO 27001 Lead Auditor, Anupam spearheads the establishment and optimization of robust information security frameworks.

FINDING THE RIGHT AUDITOR: THE ULTIMATE CHECKLIST

Selecting an auditor to implement industry-specific rules and regulations is vital. The choice can influence the company’s growth and financial health. Therefore, choosing the right auditor offers valuable insights and ensures compliance and economic stability. You...

AI Audit Guidelines and Best Practices: Applying AI Towards Its Full Potential

Artificial Intelligence is entering different industries, where it is used for customer handling, data management, and documentation processes. The interference of AI is increasing concerns regarding ethical practice and safety. Therefore, AI audits have become more...

AUDIT LOG: INFORMATION SECURITY BEST PRACTICES FOR BUSINESSES

An audit log is the best information security practice for organizations. This article elaborates on the operational process of audit logs and how companies utilize them for business growth. What is an audit log, and how does it work for organizations? For more...