In today’s rapidly evolving economic and technological environment, organizations face the enormous challenge of managing their Governance, Risk, and Compliance (GRC) responsibilities more effectively than ever before. Strong GRC technologies are more in demand because of the growing complexity of legal frameworks, data security concerns, and the need for moral business practices. GRC platforms are becoming more and more well-known as valuable resources, giving companies the ability to successfully negotiate these challenging waters.

In this blog, we will take an illuminating tour through the world of GRC, discovering the ten most exceptional GRC platforms on the market. These technologies are critical for firms to maintain regulatory compliance, manage risks, and build efficient governance frameworks. We hope to equip you with the knowledge you need to make informed decisions and improve your GRC capabilities by going into the nuances of each tool’s features, strengths, and applications. With the correct GRC solutions in hand, your firm can set off on a path to increased compliance, risk management, and governance efficiency, ushering in a new era of success.

WHAT IS A GRC TOOL?

GRC, which stands for Governance, Risk, and Compliance, combines three critical factors to oversee and manage enterprises. Governance influences decision-making, risk management addresses possible risks, and compliance assures legal compliance. It is the foundation for preserving integrity, increasing risk resilience, and ensuring compliance. In today’s complex corporate context, GRC platforms serve as a guiding compass, ensuring stakeholders of ethical practices and rigorous risk management at their core.

Furthermore, Governance Risk and Compliance tools are software solutions that streamline operations, improve workflow visibility, and enable sophisticated risk assessment. GRC tools concentrate on managing risks across finance, strategy, and operations, ensuring overall organizational resilience, unlike cybersecurity solutions.

1. Governance: Governance sets the framework within which an organization forms its decision-making, clearly distinguishing roles, duties, and processes in order to achieve corporate goals. This critical function guarantees that resources are allocated properly and that ethical business practices are followed, both of which contribute to long-term success and the trust of stakeholders who rely on the organization’s good management and principled conduct.

2. Risk: Risk management is the process of identifying, assessing, and managing potential threats to an organization’s functionality, reputation, or financial stability. In today’s ever-changing business climate, the ability to proactively manage these risks is critical for guaranteeing an organization’s continuous growth and adaptability, eventually improving resilience and capacity to survive in the face of unpredictability.

3. Compliance: Compliance refers to an organization’s dedication to following applicable laws, regulations, and industry-specific standards. This dedication is critical to avoiding legal ramifications, building confidence among stakeholders, and protecting the organization’s brand. Companies demonstrate their commitment to ethical standards and solid governance by following compliance rules, which are critical to maintaining their reputation in a competitive business market.

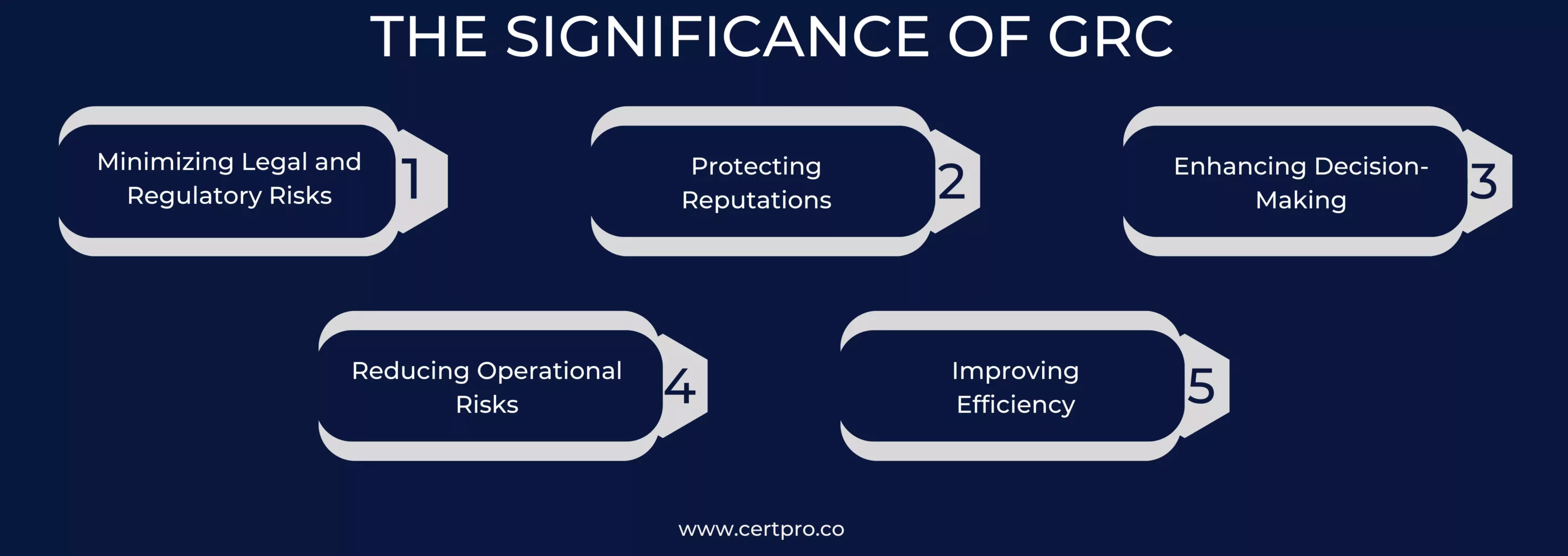

THE SIGNIFICANCE OF GRC

GRC (Governance, Risk, and Compliance) practices are not just buzzwords in the dynamic world of business and governance; they are essential components of business success. It outlines how governance processes prevent operational issues, the importance of risk management, and the efficiency benefits of GRC methods. These insights provide a thorough grasp of why GRC is such an important aspect of today’s organizational landscape.

1. Minimizing Legal and Regulatory Risks: Implementing GRC methods is critical for firms to be legally compliant, as noncompliance can result in significant penalties, legal ramifications, and reputational harm. These methods enable firms to meet regulatory requirements proactively, reducing the risks associated with legal infractions.

2. Protecting Reputations: Organizations that implement strong GRC policies are viewed as trustworthy and accountable, instilling trust in a wide range of stakeholders, including customers, partners, and investors. In today’s business market, a good reputation can provide a significant competitive advantage by attracting clients and building successful collaborations, ultimately leading to long-term growth and success.

3. Enhancing Decision-Making: Governance processes define an organization’s decision-making and execution methods. When these procedures are effective, they allow for more informed and strategic decisions, which dramatically improves the organization’s capacity to achieve its goals. In essence, excellent governance serves as a linchpin in connecting decision-making with broad objectives, improving the organization’s overall performance and success.

4. Reducing Operational Risks: Risk detection and mitigation through skilled risk management procedures are critical in avoiding operational disruptions, financial losses, and protecting an organization’s assets and resources. Organizations that address possible risks proactively not only preserve their bottom line but also assure the continuity of their operations, building resilience and ensuring long-term sustainability.

5. Improving Efficiency: GRC methods help to optimize operations by eliminating redundancy and improving resource allocation. This operational simplification not only improves efficiency but also saves money. Organizations may make more effective use of their resources by fine-tuning these processes, which is critical in today’s competitive business environment, ensuring they remain nimble, cost-effective, and well-positioned for success.

THE TOP 10 GRC TOOLS AND PLATFORMS

Let’s take a look at the top 10 GRC tools and platforms on the market right now. Each of these tools has its own unique combination of characteristics and capabilities that are designed to satisfy the different and specific needs of Governance, Risk, and Compliance (GRC) within businesses. This investigation will aid you in identifying the GRC solution that best meets your organization’s specific objectives and goals.

1. IBM OpenPages: A thorough examination of IBM OpenPages, looking into its core features and its critical role in risk management and regulatory compliance within enterprises This in-depth investigation will shed light on how OpenPages helps to improve GRC processes.

Features of IBM OpenPages:

- Streamlined compliance management through automated workflows.

- Real-time visibility into risk and compliance aspects.

- Integration of risk and compliance data for well-informed decision-making.

Advantages of IBM OpenPages:

- Embraces a comprehensive GRC approach.

- Efficiently automates various processes to enhance operational workflows.

- Provides real-time insights, enabling proactive decision-making.

Disadvantages of IBM OpenPages:

- The cost may present a barrier for small businesses, potentially limiting accessibility to its robust GRC features.

2. RSA Archer: Investigate how RSA Archer improves the efficiency of Governance, Risk, and Compliance (GRC) systems, allowing firms to make more informed decisions. This overview examines the importance of RSA Archer in optimizing GRC practices and decision-making.

Features of RSA Archer:

- Streamlined compliance management through automated workflows.

- Real-time visibility into risk and compliance facets.

- Integration of risk and compliance data to facilitate informed decision-making.

Advantages of RSA Archer:

- Embraces a comprehensive GRC approach, fostering a holistic organizational perspective.

- Efficiently automates processes, enhancing the overall operational workflow.

- Provides real-time insights, enabling proactive decision-making.

Disadvantages of RSA Archer:

- The cost may pose a barrier for small businesses, potentially limiting access to its robust GRC features.

3. MetricStream: Examine how MetricStream simplifies the complex world of Governance, Risk, and Compliance (GRC) management. Learn how MetricStream gives enterprises the tools and capabilities they need to handle regulatory challenges and efficiently maintain compliance.

Features of MetricStream:

- Streamlined compliance management through automated workflows.

- Real-time visibility into risk and compliance landscapes.

- Integration of risk and compliance data to facilitate informed decision-making.

Advantages of MetricStream:

- Offers a comprehensive GRC approach, fostering a holistic organizational perspective.

- Efficiently automates processes, enhancing overall operational workflows.

- Provides real-time insights, enabling proactive decision-making.

Disadvantages of MetricStream:

- The cost may present a barrier for small businesses, potentially limiting access to its robust GRC features.

4. SAP GRC: A thorough examination of SAP GRC, with an emphasis on its deep integration capabilities aimed at improving risk management and compliance activities within enterprises This investigation will reveal how SAP GRC can improve GRC processes.

Features of SAP GRC:

- Seamless compliance management through automated workflows.

- Real-time visibility into risk and compliance landscapes.

- Integration of risk and compliance data to facilitate well-informed decision-making.

Advantages of SAP GRC:

- Encompasses a comprehensive GRC approach, ensuring a holistic organizational perspective.

- Efficiently automates processes, optimizing overall operational workflows.

- Provides real-time insights, empowering proactive decision-making.

Disadvantages of SAP GRC:

- The cost may pose a hurdle for small businesses, potentially limiting access to its robust GRC features.

5. ServiceNow GRC: Review how ServiceNow GRC improves governance, risk assessment procedures, and compliance tracking within enterprises. This overview illustrates ServiceNow GRC’s multifarious capabilities in bolstering these essential pillars of effective GRC management.

Features of ServiceNow GRC:

- Streamlined compliance management through automated workflows.

- Real-time visibility into risk and compliance landscapes.

- Integration of risk and compliance data for informed decision-making.

Advantages of ServiceNow GRC:

- Encompasses a comprehensive GRC approach, ensuring a holistic organizational perspective.

- Efficiently automates processes, optimizing overall operational workflows.

- Provides real-time insights, empowering proactive decision-making.

Disadvantages of ServiceNow GRC:

- The cost may be a limiting factor for small businesses, potentially hindering access to its robust GRC features.

6. Lockpath Keylight: Discover the comprehensive approach to risk management and compliance that Lockpath Keylight offers. This analysis focuses on the characteristics and capabilities that make Lockpath Keylight a vital solution for firms looking to improve their GRC procedures and mitigate risks.

Features of Lockpath Keylight:

- Streamlined compliance management through automated workflows.

- Real-time visibility into risk and compliance landscapes.

- Integration of risk and compliance data to facilitate informed decision-making.

Advantages of Lockpath Keylight:

- Embraces a comprehensive GRC approach, ensuring a holistic organizational perspective.

- Efficiently automates processes, optimizing overall operational workflows.

- Provides real-time insights, empowering proactive decision-making.

Disadvantages of Lockpath Keylight:

- The cost may present a challenge for small businesses, potentially limiting access to its robust GRC features.

7. NAVEX Global: Look into NAVEX Global’s suite of GRC technologies, which have been methodically designed to strengthen enterprises’ ethical and compliance initiatives. This investigation will shed light on how NAVEX Global’s products support GRC efforts by emphasizing ethical principles and regulatory compliance.

Features of NAVEX Global:

- Streamlined compliance management through automated workflows.

- Real-time visibility into risk and compliance landscapes.

- Integration of risk and compliance data for informed decision-making.

Advantages of NAVEX Global:

- Encompasses a comprehensive GRC approach, emphasizing ethical principles and regulatory compliance.

- Efficiently automates processes, optimizing overall operational workflows.

- Provides real-time insights, empowering proactive decision-making.

Disadvantages of NAVEX Global:

- The cost may pose a challenge for small businesses, potentially limiting access to its robust GRC features.

8. BWise: Review how BWise acts as a catalyst for integrated Governance, Risk, and Compliance (GRC) efforts within enterprises, especially in the context of changing regulatory landscapes. This investigation elucidates how BWise enables firms to efficiently handle regulatory changes.

Features:

- Streamlined workflows for managing compliance with automated processes.

- Real-time visibility, providing a dynamic overview of risk and compliance status.

- Integration of risk and compliance data for well-informed decision-making.

Advantages:

- A holistic GRC approach encompassing governance, risk, and compliance seamlessly

- Efficient automation of processes enhances operational effectiveness.

- Real-time insights empower organizations to respond promptly to changes.

Disadvantages:

- The cost may pose a hurdle for small businesses, potentially making it prohibitive.

9. Resolver: Get more into Resolver’s GRC software, with a focus on its risk management and incident reporting capabilities. This examination will provide a thorough knowledge of how Resolver assists organizations in effectively addressing risks and handling incidents.

Features:

- Streamlined, automated workflows are designed for effective compliance management.

- Real-time visibility provides insights into the current state of risk and compliance.

- Integration of risk and compliance data facilitates well-informed decision-making.

Advantages:

- Embraces a comprehensive GRC approach tailored to organizational needs.

- Efficient automation enhances the effectiveness of various processes.

- Real-time insights empower proactive decision-making in risk management.

Disadvantages:

- The cost factor may present challenges for smaller businesses, potentially limiting accessibility to the software’s benefits.

10. LogicGate: Take a closer look at LogicGate’s GRC automation platform and its critical role in risk mitigation and compliance assurance. This investigation reveals how LogicGate’s innovative platform enables organizations to effectively manage risks and meet regulatory requirements, resulting in a secure and compliant operational environment.

Features:

- Streamlined automated workflows are designed for effective compliance management.

- Real-time visibility provides insights into the current state of risk and compliance.

- Integration of risk and compliance data for well-informed decision-making.

Advantages:

- Adopts a comprehensive GRC approach tailored to organizational nuances.

- Efficient automation optimizes the effectiveness of diverse processes.

- Real-time insights empower proactive decision-making in risk management.

Disadvantages:

- The cost factor may present challenges for smaller businesses, potentially limiting accessibility to the platform’s benefits.

HOW TO CHOOSE THE BEST GRC SOLUTION?

Choosing the best Governance, Risk, and Compliance (GRC) platform for your firm is a key decision. To make an informed decision, you must first examine your specific business needs and establish clear goals for your GRC program. Scalability, versatility, integration possibilities, ease of use, and customization choices are all important considerations. Look for GRC technology that provides extensive reporting and analytics, is compliant with industry standards, and has a solid vendor reputation and outstanding support. Don’t forget to evaluate the total cost of ownership and do a proof of concept. Engage important stakeholders and conduct a thorough review process to ensure you select the GRC product that best meets the needs of your firm.

Finally, choosing the correct GRC technology necessitates a strategic approach that includes due diligence, extensive research, and a focus on aligning the tools with your organization’s goals and objectives. By taking these important criteria into account, you can ensure that your chosen GRC technology improves your risk management and compliance efforts while also adapting to your organization’s changing demands.

WHICH INDUSTRIES TYPICALLY NEED GRC TOOLS?

When it comes to risk and compliance, the first things that come to mind are probably finance, healthcare, and manufacturing. However, practically every industry faces its own set of hazards and compliance requirements. As a result, Governance Risk and Compliance tools are useful across the board. Consider the retail industry, which is struggling with PCI DSS certification in order to take credit card information. Furthermore, any firm involved in European transactions must follow the strict GDPR requirements.

GRC software may not be a primary priority for smaller organizations, particularly those in less-regulated industries. Using basic cybersecurity software and business continuity strategies, they can typically properly meet their risk and compliance demands. Nonetheless, businesses that lack a defined GRC framework must accelerate the use of these critical technologies. They expose themselves to unnecessary risks and undermine the security of their clients’ sensitive data if they do not have them.

THE TOP 5 GRC CHALLENGES

1. Absence of Visibility: The terms Governance, Risk, and Compliance (GRC) refer to a set of complex processes used in an organization to control risks, make sure that it complies with the law, and create efficient governance. Notwithstanding these goals, a significant lack of visibility presents several difficulties. This lack of visibility hampers departmental collaboration, which makes it challenging to create efficient regulations that guarantee compliance and minimize risk.

Furthermore, it is difficult to pinpoint areas for improvement because of the inadequate understanding of GRC performance. It is also difficult to prioritize GRC within the organizational framework when there is a lack of visibility. Fundamentally, the difficulties center on the organization’s capacity to fully comprehend, plan, and rank GRC operations in order of importance for maximum efficacy.

2. Manual Procedures: Manual procedures in GRC (Governance, Risk, and Compliance) refer to conventional techniques like emailing, faxing, and manual filing that are used to gather, store, and share information. These procedures also include doing audits and manually evaluating compliance concerns.

The drawbacks of manual processes include higher expenses and longer processing times, particularly when handling several compliance issues for a company. Automation resolves these difficulties by saving both money and time. Deadlines are missed, and costly mistakes are common in manual operations.

Additional difficulties include insufficient and inconsistent data, which might produce unreliable outcomes. Another disadvantage is the lack of insight on GRC performance and possible compliance problems. Since hand procedures frequently lack comprehensive documentation, tracking changes can be challenging.

3. Warehouses of data: In GRC management, an organization’s data silos are disconnected and distinct data sources that obstruct the development of an all-encompassing enterprise-wide perspective of risks and compliance needs. Among the difficulties are duplicate data, erroneous reporting, ineffective resource management, a lack of consistency, restricted visibility, higher expenses, and weakened decision-making. In order to overcome these obstacles and promote integration for a more unified and uniform GRC approach, data silos must be broken down.

4. Insufficient Resources: Organizations face a major difficulty in managing Governance, Risk, and Compliance (GRC) when they lack appropriate resources. Implementing the required controls, keeping an eye on performance, and upholding an efficient GRC program become difficult without sufficient resources. Small resources, lack of executive assistance, insufficient communication, and challenges in quantifying results worsen this problem. Enough funding, leadership support, well-thought-out communication strategies, and quantifiable measures to monitor GRC performance are needed to overcome these challenges.

5. Ineffective communication: One of the biggest obstacles to effective adoption and process adherence in GRC management is poor communication. Misunderstandings, a delay in making decisions, and trouble controlling risks might result from this. Imprecise communication and stakeholders’ lack of understanding hinder the regular maintenance of GRC procedures, potentially leading to accountability issues. Among the difficulties are weak governance, insufficient cooperation, miscommunication, and decreased production. To tackle these problems, communication tactics must be improved, goals must be made clear, cooperation must be encouraged, and GRC procedures must be made transparent. Successful GRC governance and implementation depend on effective communication.

WHY AND WHO USE GRC TOOLS?

GRC tools are essential software programs used by a variety of businesses, such as manufacturing, retail, insurance, healthcare, and financial services. These technologies make it easier to administer policies, identify risks, restrict user access, and simplify compliance. The Riskonnect GRC platform combines governance, management, and reporting activities across the entire organization and is specifically tailored for experts in risk management, information security, compliance, and audit. This guarantees a thorough strategy for resolving issues unique to a certain industry, strengthening organizational resilience, and upholding compliance in a constantly changing business environment.

FAQ

What is the primary purpose of Governance Risk and Compliance tools and platforms?

GRC, or Governance Risk and Compliance combines three crucial elements for managing enterprises. It influences decision-making, manages risks, and ensures legal compliance.

How can GRC tools help organizations minimize legal and regulatory risks?

Organizations can adhere to regulations by proactively using GRC methods, thus preventing risks and expenses linked to legal non-compliance.

What are the benefits of having strong GRC practices for an organization's reputation?

Strong GRC processes instill trustworthiness and accountability in enterprises, increasing stakeholder trust. This, in turn, attracts clients, partners, and investors, increasing overall credibility and success.

How do GRC tools enhance decision-making in an organization?

GRC technologies help firms make educated, strategic decisions by streamlining governance processes. This improvement in decision-making eventually improves organizational performance and success.

What is a GRC tool?

A GRC tool, or Governance Risk and Compliance tool, is software that streamlines operations, enhances workflow visibility, and enables sophisticated risk assessment to manage legal and regulatory responsibilities effectively.

About the Author

BHOOMIKA JOIS

Bhoomika Jois is a creative content writer specializing in compliance, ISO 27001, GDPR, and SOC 2. As a Social Media Marketing Specialist, she amplifies her engaging content. Bhoomika’s knack for simplifying complex topics makes compliance and cybersecurity accessible to all.

HOW DOES THE NIST CYBERSECURITY FRAMEWORK FUNCTION, AND WHY IS IT IMPORTANT?

Emerging cyber threats make cybersecurity an essential consideration for organizations handling and managing data. In this regard, the NIST cybersecurity framework applies to improving your cybersecurity program. It is a set of guidelines that helps improve your...

UNDERSTANDING ISO 42001: A GUIDE FOR RESPONSIBLE AI MANAGEMENT SYSTEMS

The invention of artificial intelligence (AI) has changed the operational processes of many industries. However, the rapid growth of technology increases ethical, security, and privacy-related concerns. Therefore, the International Organization for Standardization...

EUROPEAN UNION’S ARTIFICIAL INTELLIGENCE ACT: HOW THIS GROUNDBREAKING LAW AFFECTS YOUR BUSINESS

Nowadays, Artificial Intelligence (AI) is transforming our lives exceptionally well. AI is now streamlining healthcare services, providing virtual assistance, and fulfilling queries. Technologies have boons and curses. Similarly, AI creates many concerns about...