In today’s complex and ever-changing business landscape, adherence to Regulatory requirements is crucial for organizations to ensure ethical conduct, mitigate risks, and maintain legal compliance. Compliance frameworks are essential to helping businesses navigate these regulatory complexities effectively. Understanding and complying with regulatory requirements is of utmost importance for businesses. These requirements protect consumers, ensure fair competition, safeguard data privacy, and promote ethical business practices. Failing to meet these obligations can result in severe consequences such as legal penalties, financial losses, reputational damage, and loss of stakeholder trust.

Implementing a robust compliance framework enables organizations to stay abreast of regulatory changes, establish clear policies and procedures, and effectively manage risks. Compliance frameworks provide a structured approach to identifying, assessing, and addressing regulatory requirements, ensuring a proactive and comprehensive compliance strategy. Moreover, compliance frameworks foster a culture of transparency, integrity, and accountability within the organization, instilling trust among employees, customers, and partners. By adhering to regulatory requirements, businesses can reap numerous benefits in the marketplace. Compliance frameworks also enable organizations to adapt to evolving regulatory landscapes, maintain a positive reputation, and gain a competitive edge.

WHAT IS A COMPLIANCE FRAMEWORK?

UNDERSTANDING REGULATORY COMPLIANCE

IMPORTANCE OF REGULATORY COMPLIANCE

CHALLENGES ASSOCIATED WITH REGULATORY COMPLIANCE

BENEFITS OF ENSURING REGULATORY COMPLIANCE FOR ORGANIZATION

EXPLORING REGULATORY REQUIREMENTS

WHAT ARE REGULATORY COMPLIANCE REQUIREMENTS?

CONSEQUENCES OF NON-COMPLIANCE

What IS A COMPLIANCE FRAMEWORK?

A compliance framework is a structured system of policies, procedures, and controls to ensure the organization implements relevant laws, regulations, industry standards, and internal policies. It aims to establish a robust security posture and minimize the risk of compliance violations. They include a roadmap for implementing security policies, internal controls for managing them, and procedures for auditing and monitoring compliance.

Compliance frameworks can be industry-specific or adaptable to various organizations. Adopting a compliance framework demonstrates an organization’s dedication to maintaining a compliant and secure environment, fostering trust with customers, partners, and other stakeholders.

UNDERSTANDING REGULATORY COMPLIANCE

Regulatory compliance is the ongoing process of adhering to rules, regulations, standards, and specifications that apply to a corporation’s operations. It encompasses ensuring that a company operates within the legal framework and actively strives to meet all necessary regulatory requirements. Compliance is essential for businesses to retain their licenses and uphold a positive reputation with authorities.

Two fundamental factors often shape a regulatory compliance framework:

1. Regulatory requirements

2. The firm actively undertakes specific business activities.

These factors are subject to change over time, necessitating adjustments to the Compliance Framework to reflect these changes.

IMPORTANCE OF REGULATORY COMPLIANCE

Regulatory compliance is critical for protecting consumers, workers, and assets since it requires adherence to relevant laws, regulations, and industry standards. By actively complying with these requirements, organizations can prevent costly penalties, fines, and reputational harm arising from non-compliance. Regulatory compliance is essential to bolstering customer and investor confidence and ensuring that organizations operate safely and responsibly.

CHALLENGES ASSOCIATED WITH REGULATORY COMPLIANCE

Failure to adhere to mandatory regulatory compliance practices can result in repercussions, including participation in remediation programs that involve on-site compliance audits and inspections by regulatory agencies. Non-compliant organizations often face monetary fines and penalties, while repeated or significant breaches can harm a brand’s reputation.

Complying with regulations can be financially demanding, requiring investments in infrastructure and personnel. Companies must allocate capital to meet compliance laws and regulations while striving to satisfy stakeholders and maintain beneficial business processes. Highly regulated industries like finance and healthcare face particularly acute financial challenges related to compliance. Additional business strategy-related challenges in maintaining regulatory compliance include:

- Assessing the impact of emerging regulations on business direction and existing models

- Fostering a compliance culture and promoting it throughout the organization

- Determining the appropriate compliance roles, responsibilities, and functions within legal, compliance, audit, and business departments.

- Staying ahead of compliance trends and integrating efficient regulatory processes.

The ever-evolving landscape of consumer technologies poses further compliance complexities. Personal mobile devices in the workplace raise concerns about sensitive company data storage. The proliferation of IoT devices also introduces compliance vulnerabilities without adequate security measures. Digitized companies must stay proactive by keeping up with required updates and promptly patching software to maintain compliance and mitigate risks.

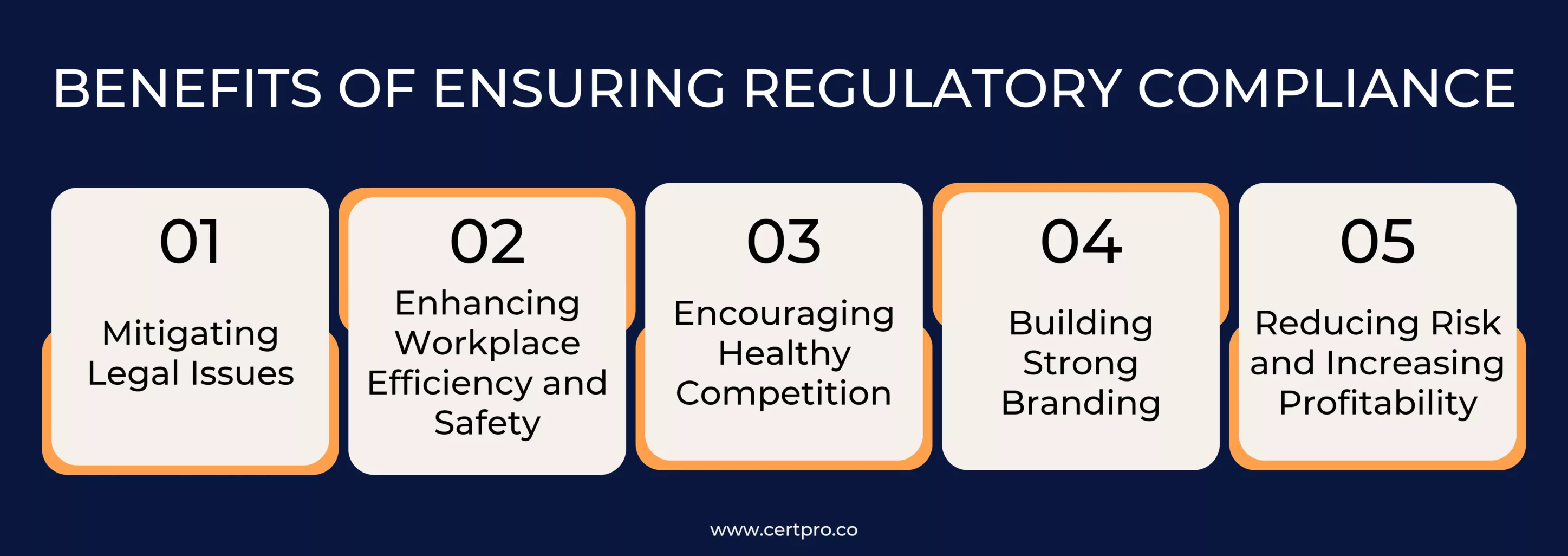

BENEFITS OF ENSURING REGULATORY COMPLIANCE FOR ORGANIZATION

Maintaining regulatory compliance brings numerous advantages to organizations, yielding both short-term and long-term benefits. Key benefits include:

- Mitigating Legal Issues: Regulatory compliance frameworks ensure organizations fulfill their legal obligations, reducing the risk of costly legal disputes. By adhering to regulations like GDPR, companies handling user data can prevent legal complications associated with non-compliance.

- Enhancing Workplace Efficiency and Safety: Implementing rules against discrimination and harassment to enforce safety measures fosters a productive and safe work environment. It promotes employee well-being, improves productivity, and safeguards against accidents or incidents.

- Encouraging Healthy Competition: Regulatory compliance prevents unfair monopolies and supports fair market competition. By complying with regulations, organizations embrace equitable practices, drive innovation, and encourage the delivery of high-quality products and services.

- Building Strong Branding: Adhering to regulatory compliance enhances public perception and stakeholder confidence. Communicating an organization’s commitment to compliance processes, ethical standards, and norms in branding and marketing efforts builds a positive reputation and fosters trust among stakeholders.

- Reducing Risk and Increasing Profitability: Regulatory compliance helps mitigate risks and maintain customer trust, resulting in sustained profitability. Securing customer data and preventing breaches can differentiate an organization from competitors, attracting loyal customers. Reliable compliance practices also facilitate strong partnerships with business allies, increased synergies, and long-term collaborations.

Through regulatory compliance, organizations can enjoy these benefits, which contribute to their overall success, reputation, and sustainable growth.

EXPLORING REGULATORY REQUIREMENTS

Regulators and compliance officers enforce regulatory requirements, also known as regulations, which are rules that an organization must abide by. These requirements can encompass qualifications, processes, or record-keeping obligations. In today’s technological world, regulatory requirements hold immense importance as they aim to protect people, assets, data, and integrity from a collection of threats. They also establish industry-wide minimum standards, instilling customer confidence and enabling companies to manage risks effectively. Furthermore, regulatory requirements contribute to achieving business goals by providing a level playing field for all competitors, irrespective of their resources, as companies align with the best practices outlined in these regulations.

WHAT ARE REGULATORY COMPLIANCE REQUIREMENTS?

Regulatory compliance requirements are specific standards that organizations must adhere to based on their industry. It is crucial to research and understand the compliance requirements that directly affect your business. Some industries may require outside consultation to implement the necessary processes for meeting regulatory standards.

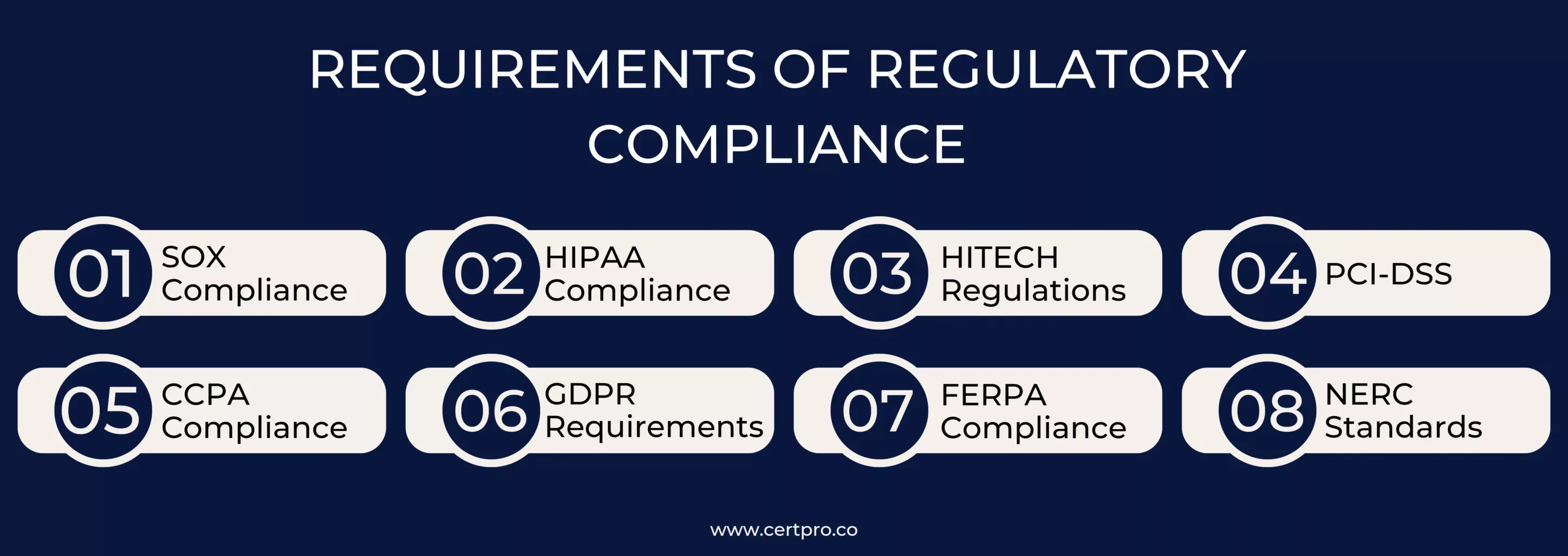

Outlined below are examples of regulatory compliance requirements and the industries they apply to:

SOX Compliance: After the Enron scandal, organizations should conduct internal audits to ensure adherence to SOX regulations, which govern internal accounting practices for publicly traded companies.

HIPAA: Healthcare organizations must comply with HIPAA to ensure secure storage, management, and disclosure of patient data, promoting improved safety and data management practices.

HITECH Regulations: HITECH establishes controls for healthcare organizations to manage digital patient data, including collection, storage, and secure transfer methods.

PCI-DSS: Merchants and payment processors must comply with PCI-DSS to protect financial information, employing proper data storage and secure data transfer protocols to combat rising credit card fraud.

CCPA Compliance: Businesses working with California consumer data must adhere to CCPA regulations, which mandate transparent disclosure of data handling practices and the ability to delete consumer data upon request.

GDPR Requirements: Organizations using EU consumer data must comply with GDPR, enabling EU consumers to have greater control over their data by implementing measures for data storage and deletion upon request.

FERPA Compliance: Educational institutions collecting student data must protect it according to FERPA regulations, implementing controls to prevent unauthorized access and safeguard educational records from theft.

NERC Standards: NERC helps utility and energy companies combat state-sponsored cyber-attacks, reducing the risk of infrastructure compromise and its potential impact on residents through the implementation of protective measures.

CONSEQUENCES OF NON-COMPLIANCE

Non-compliance occurs when rules and regulations are not adhered to, whether it involves an individual employee or systemic issues within the entire business. Discovery of non-compliance can trigger further actions from regulatory bodies, as they take violations of compliance frameworks and reporting requirements seriously.

Data privacy, particularly the handling of personal data, stands out as a significant compliance obligation across industries. Companies are obligated to implement robust security measures for safeguarding personal information, with the emergence of GDPR further emphasizing this aspect. Failure to comply with regulations can result in monetary fines and other penalties, often imposed following investigations conducted by external compliance officers.

FAQ

WHICH ELEMENTS MAKE UP THE COMPLIANCE FRAMEWORK?

The elements of a compliance framework include selecting the appropriate framework, choosing the right controls, conducting a risk analysis, and striving for continuous improvement. These elements work together to establish an effective compliance program that aligns with regulatory requirements and enables the ongoing enhancement of compliance practices.

WHAT IS THE PURPOSE OF REGULATORY REQUIREMENTS IN COMPLIANCE FRAMEWORKS?

The purpose of regulatory requirements in compliance frameworks is to establish a set of rules and standards that organizations must follow to ensure legal and ethical operations. These requirements aim to protect consumers, employees, and stakeholders, promote fair competition, and maintain industry standards.

WHY IS IT IMPORTANT FOR ORGANIZATIONS TO HAVE A CLEAR UNDERSTANDING OF REGULATORY REQUIREMENTS?

Having a clear understanding of regulatory requirements is crucial for organizations to ensure they operate within the boundaries of the law. It helps them avoid penalties, maintain licenses, and stay in good standing with regulatory bodies. Understanding regulatory requirements also enables organizations to implement appropriate compliance measures and mitigate compliance-related risks.

HOW CAN ORGANIZATIONS STAY UPDATED ON CHANGING REGULATORY REQUIREMENTS?

Organizations can stay updated on changing regulatory requirements by actively monitoring regulatory updates, subscribing to industry newsletters or publications, participating in industry forums or associations, engaging with regulatory bodies, and seeking legal or compliance expertise. It is important to establish mechanisms for ongoing compliance monitoring and adapt the compliance framework accordingly.

ARE REGULATORY REQUIREMENTS THE SAME FOR ALL INDUSTRIES?

No, regulatory requirements can vary across industries. Each industry may have specific regulations and standards tailored to its unique characteristics, risks, and objectives. Organizations need to identify the regulatory requirements specific to their industry and comply with them accordingly.

HOW DOES THE NIST CYBERSECURITY FRAMEWORK FUNCTION, AND WHY IS IT IMPORTANT?

Emerging cyber threats make cybersecurity an essential consideration for organizations handling and managing data. In this regard, the NIST cybersecurity framework applies to improving your cybersecurity program. It is a set of guidelines that helps improve your...

UNDERSTANDING ISO 42001: A GUIDE FOR RESPONSIBLE AI MANAGEMENT SYSTEMS

The invention of artificial intelligence (AI) has changed the operational processes of many industries. However, the rapid growth of technology increases ethical, security, and privacy-related concerns. Therefore, the International Organization for Standardization...

EUROPEAN UNION’S ARTIFICIAL INTELLIGENCE ACT: HOW THIS GROUNDBREAKING LAW AFFECTS YOUR BUSINESS

Nowadays, Artificial Intelligence (AI) is transforming our lives exceptionally well. AI is now streamlining healthcare services, providing virtual assistance, and fulfilling queries. Technologies have boons and curses. Similarly, AI creates many concerns about...