Regulatory compliance signifies the organization’s adherence to industry-specific laws and regulations. The organization can face legal punishment in case of any violation of regulatory compliance. Now, what is regulatory compliance in general? Simply put, it is industry-related, with specific rules that the organization needs to follow. Therefore, the healthcare industry should follow HIPAA, and payment and credit card-related businesses should follow PCI DSS. In addition, GDPR is applicable for organizations managing and handling European citizens’ data, and CCPA is for securing data in California. In this regard, you should always remember that your organization might not be subject to one regulatory standard. Thus, one organization can follow multiple regulatory standards as per industry demands. Therefore, it is essential to recognize the industry regulatory standards considering your business size and complexity.

The regulatory compliance blog will help you understand the importance of regulations and the implementation process. We will also discuss the challenges and consequences of non-compliance. This article clarifies your thoughts and understanding regarding regulatory compliance.

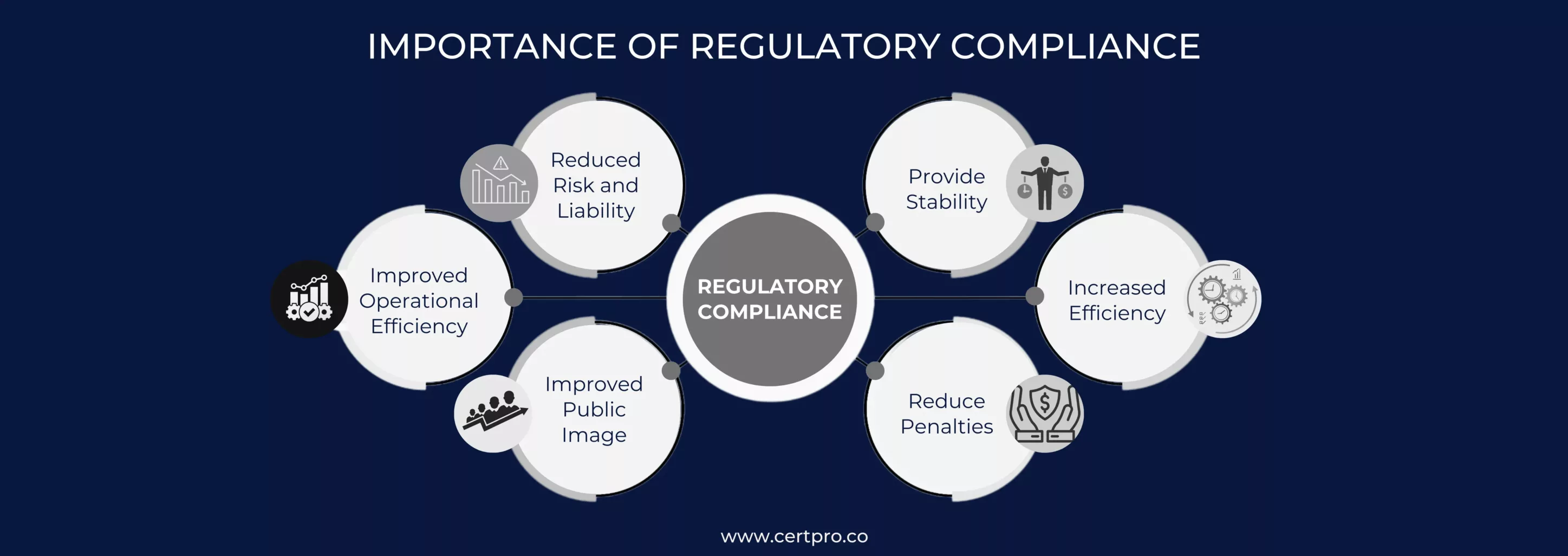

IMPORTANCE OF REGULATORY COMPLIANCE

The changing business landscape makes regulatory compliance more relevant and prominent for industries. Therefore, implementing compliance management requires compliance officers and managers in your firm. Their prime duties will be monitoring regulations and compliance. The benefits of compliance are discussed below:

1. Improved Operational Efficiency: Regulatory compliance helps organizations conduct their business by following regulations. Therefore, it assists in streamlining the operational process and improving the operational efficacy. The regulatory compliance framework guides organizations to attain their business possibilities.

2. Reduced Risk and Liability: Implementing regulatory compliance reduces organizations’ risk of financial liabilities. Furthermore, if data protection is your organization’s prime goal, then GDPR and CCPA are appropriate for you. The organization must secure data to avoid misuse and cyber threats.

3. Improved Public Image: Organizations with regulatory compliance frameworks achieve positive promotion, influencing their trust and confidence in the market.

4. Provide Stability: Organizations that comply with specific regulations can help their business grow and thrive. The compliance report offers competitive advantages. In addition, the certification creates trust and global recognition among stakeholders. Transparency about the organization’s compliance processes helps clients collaborate and increase profitability.

5. Increased Efficiency: Another critical aspect of implementing regulatory compliance is ensuring data protection. Consequently, data breaches can damage customer retention and growth. Therefore, the customers move to the organizations strictly following the regulations compliance. It assures their data protection and security.

6. Reduce Penalties: It recognizes that following regulatory standards influences business growth and continuity. Moreover, it helps avoid fines and provides financial stability. Data breaches increase the risk of legal difficulties and huge penalties. It also reduces the organization’s reputation and customers’ trust, causing business growth to stagnate.

CHALLENGES WITH REGULATORY COMPLIANCE

Organizations with a specific regulatory compliance framework need better business growth. Sometimes, the client forces the organization to undergo remediation programs, including on-site compliance audits. Again, non-compliance affects brand reputation. However, an organization can avoid implementing compliance due to the financial burdens. On the other hand, adhering to compliance can bring profitability in the future.

Regulatory compliance is crucial for organizations working in the healthcare and financial sectors. The challenges that come with compliance are listed below:

- Recognizing how regulations influence business growth and model.

- Developing a compliance culture and promoting the culture within the organization.

- Recruiting a compliance manager and auditing team to monitor the process is essential.

- Integrates regulatory processes that improve efficiency.

ENSURE REGULATORY COMPLIANCE FOR YOUR ORGANIZATION

The execution of regulatory compliance requires analyzing the unique requirements of your organization. In addition, the industry-specific demands must be considered, and adequate measures must be selected. The following steps help in achieving regulatory compliance:

- Identify Applicable Regulations: Recognize the laws and regulations appropriate for your organization. It can be federal or municipal rules,

- Determine Requirements: Consider a specific regulatory plan and implement it according to the organization’s scope and capabilities.

- Document Compliance Processes: Documentation of compliance processes and regulations is essential. It helps in their regulatory audits.

- Monitoring the Changes: Regulatory compliance requires continuous monitoring and upgradation. Therefore, any addition of policies or implementation needs to be incorporated. Similarly, it is important to educate the employees about the new updates.

Penalties of Non-compliance

A regulatory compliance checklist can help your organization to adhere to compliance. However, non-compliance can cause significant penalties. Some of them are discussed below:

1. Financial Penalties: In the case of HIPAA non-compliance, the penalties depend on the severity of the breach. However, in GDPR, two different tiers of penalties exist. Both of them contain significant financial obligations.

2. Loss of Licensing: Some non-compliance causes organizations to lose authorization. In this regard, non-compliance with CMMC causes a loss of certification.

3. Legal Liability: Non-compliance causes severe harm to the organization or individuals and may cause legal troubles. In the case of HIPAA, legal penalties can compel distress within the organizations.

Impact on Business Operations: Some regulations have been implemented to improve the business and its growth. Similarly, PCI DSS implementation secures the data of financial transactions. Therefore, if the merchant fails to comply with PCI DSS, it will not cause lawsuits, but their rating will decrease. Hence, merchants with poor ratings can drive higher fees and limited payment processing capacities, reducing business growth and possibilities.

POPULAR REGULATORY COMPLIANCE FRAMEWORKS

Regulatory compliance is only fixed for some organizations. Therefore, the security framework is tailored to the organization’s unique needs. Here, we discuss some common regulatory frameworks that ensure data protection, integrity, and financial stability.

1. General Data Protection Regulation: GDPR is mandatory for organizations handling and managing the personal data of EU citizens. It is a global standard for safeguarding personal data and avoiding data breaches. The measures of GDPR include privacy assessment, data protection controls, and data breach notifications. Therefore, non-compliance results in hefty penalties.

2. Health Insurance Portability and Accountability Act: HIPAA is applicable for securing patient data in the healthcare industry. Protecting the patients’ data prevents data breaches and legal liabilities. Therefore, healthcare organizations must implement access controls, risk assessment, and encryption to protect the data. Thus, violation of the regulations can cause legal and financial penalties.

3. Payment Card Industry Data Security Standard: PCI DSS ensures the security of card transactions. The regulations monitor the card data handling process. Compliance with the regulation protects financial transactions and data fraud. Furthermore, the PCI DSS implements encryption for data and conducts vulnerability assessments. Thus, non-compliance leads to financial consequences.

4. California Consumer Privacy Act: The CCPA promotes consumer control over their data and supports consumers’ privacy rights in the USA. Therefore, applying the CCPA requires strict data protection practices and transparency in the data collection and handling process. Non-compliance can result in huge fines and lawsuits.

5. Sarbanes-Oxley Act: SOX controls financial reporting and prevents corporate fraud. It also helps in corporate governance. Therefore, trade companies must comply with SOX for proper functioning. The regulations maintain transparency and integrity of financial reports, restoring the public’s and stakeholders’ trust and helping grow businesses. Generally, public trade companies implement internal controls and conduct financial audits to avoid non-compliance risk.

REGULATORY COMPLIANCE IN CYBERSECURITY

Securing sensitive data is crucial for industries that deal with customers’ data. However, regulatory compliance is critical to understand and implement. Thus, you can seek help from CertPro. If you need assistance or support, CertPro can help you comply with the law. Cybersecurity requires less effort in execution and implementation. Therefore, the organization must incorporate a firewall to protect the data from external attacks. In addition, the use of antivirus software improves data security. Your organization needs to review and monitor the compliance standards. CertPro can help you design a better infrastructure and controls for maintaining cyber security. We assure quality services within your budget.

IMPLEMENT REGULATORY COMPLIANCE FOR YOUR ORGANIZATION

The implementation process is described below:

1. Audit the Environment: Before implementing a plan, determine your organization’s risks and weaknesses. This will help you design cybersecurity controls.

2. Hire a Compliance Officer: A compliance officer helps implement industry-specific compliance regulations. In addition, the officer guides your organization regarding the changing laws and regulations.

3. Educate Employees: Employees play an essential role in adhering to compliance. Therefore, employee training is crucial in avoiding the risk of non-compliance.

4. Support Policies: The organization must work on existing policies and follow the implemented controls for compliance.

5. Continual Improvements: Compliance requires continuous monitoring and improvement. Therefore, the monitoring process recognizes the areas of improvement. The organizations must plan accordingly to improve the overall controls. Suppose your organization has suffered from cyber-attacks. Thus, you must learn from the attacks and improve the measures to prevent further incidents.

REGULATORY COMPLIANCE WITH CERTPRO

The regulatory compliance checklist is not only applicable to specific sectors or industries. It is relatable to every industry as it is crucial for organizations’ operational procedures. Many compliance regulations work for data protection, and others work to keep the data accurate and consistent. On the other hand, some regulations outline the internal process of managing and accessing the data that ensures ethical business practice.

In precise terms, regulatory compliance ensures your organization’s data safety and accuracy. However, violating data security law could result in penalties. Therefore, you can get support and guidance from CertPro. Our skilled professionals will assess the weaknesses of your existing policies and recommend adequate controls for improvement. We assure you that our services will save precious time and effort that can be utilized for business growth. For more details and precise suggestions, kindly contact us through CertPro.co and connect with us.

FAQ

What is the Compliance Assessment Checklist?

A compliance checklist helps assess the efficacy of controls in achieving compliance regulations and identifies the risk of non-compliance.

Why do you need regulatory compliance for your Company?

It is essential for improving performance and eliminating internal errors. A growing company requires compliance to increase its visibility, asses the areas of weaknesses, and prevent the financial burden.

Is regulatory compliance a skill?

Regulatory compliance specialists must have technical skills. Their skills help audit the regulatory compliance process and suggest appropriate controls for improving compliance.

How many types of Compliance are there?

The compliance is divided into two categories: corporate compliance and regulatory compliance. Both compliances involve the implementation of regulations and practices.

What is a regulatory compliance report?

Regulatory compliance reports signify an organization’s adherence to regulatory requirements of the organization. The external auditing team assesses the regulations to identify the compliance status.

About the Author

SUBBAIAH KU

Subbaiah Ku is the Regional Director for CertPro in Oman, bringing a wealth of expertise in process and system auditing. As a seasoned lead assessor, Subbaiah is dedicated to ensuring the highest standards in compliance and security. His unique blend of technical acumen, rooted in Mechanical Engineering, is complemented by a diverse range of certifications and extensive training.

HOW DOES THE NIST CYBERSECURITY FRAMEWORK FUNCTION, AND WHY IS IT IMPORTANT?

Emerging cyber threats make cybersecurity an essential consideration for organizations handling and managing data. In this regard, the NIST cybersecurity framework applies to improving your cybersecurity program. It is a set of guidelines that helps improve your...

UNDERSTANDING ISO 42001: A GUIDE FOR RESPONSIBLE AI MANAGEMENT SYSTEMS

The invention of artificial intelligence (AI) has changed the operational processes of many industries. However, the rapid growth of technology increases ethical, security, and privacy-related concerns. Therefore, the International Organization for Standardization...

EUROPEAN UNION’S ARTIFICIAL INTELLIGENCE ACT: HOW THIS GROUNDBREAKING LAW AFFECTS YOUR BUSINESS

Nowadays, Artificial Intelligence (AI) is transforming our lives exceptionally well. AI is now streamlining healthcare services, providing virtual assistance, and fulfilling queries. Technologies have boons and curses. Similarly, AI creates many concerns about...